Marktbericht

Informieren Sie sich über alle wichtigen Entwicklungen auf den Edelmetallmärkten in unseren regelmäßigen Marktberichten.

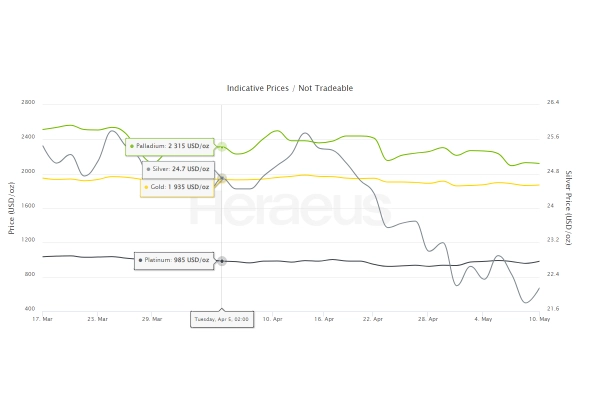

Precious metals caught up in post-tariff sell-off

Den Marktbericht der aktuellen Woche finden Sie auf der Englischen Sprachversion

Anmeldung für den Marktbericht (nur auf Englisch verfügbar)

Sie möchten unseren Marktbericht als E-Mail erhalten? Dann melden Sie sich jetzt gerne über das folgende Formular dazu an.

Nach Absenden des Formulars erhalten Sie einen Aktivierungslink per E-Mail. Bitte bestätigen Sie dort per Klick auf den Link Ihre Anmeldung. Selbstverständlich können Sie sich jederzeit problemlos vom Newsletter wieder abmelden. Am Ende eines jeden Newsletters finden Sie einen entsprechenden Abmeldelink.